A new study on the profitability of angel investing, made by the Finnish Business Angel Network (FiBAN) together with Ruben Moring (Åbo Akademi University), is the first broad study on the national angel activity in Finland. This is the largest study made about the angel exits in the Nordics.

By Claes Mikko Nilsen

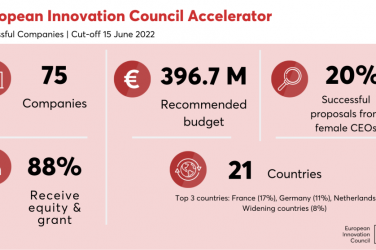

For professional angel investors, the role of exits is vital and maintains interest towards startup investing. The study covered 126 business angel exits measuring the Internal Rate of Return (IRR) that observes the profitability of the whole investment lifecycle. The key results of the study show that the pooled IRR is 25% and overall realization multiple is 3.75. This shows that the IRR of the exits of professional business angels in Finland is excellent and in line with international studies. However, more than a half (54%) of the exits that were reported during the survey were unprofitable. Also these results are in line with the general risk level of the business angels.

The survey included only one IPO and no unicorn exits. Therefore, the results show that also smaller exits can be quite successful. The average holding period in Finland was 5,5 years, which is longer compared to the international level. Finnish business angels have also been very active with their portfolio companies; on average they have used 28 hours in a month for a company.

“This survey is an excellent initiative to raise understanding on the profitability on angel investing, and compare the activity internationally. By these means, the results seem excellent. Even if an entrepreneur is not expected to actively think of the exit possibilities, for many investors this is a matter that needs to be planned.” comments Torsti Tenhunen, Chairman of FiBAN, in a press release.

Investors with exits behind them bring positive returns

Even though the returns have been excellent it’s important to notice the high risk of angel investing. Investors’ experience and activity in the startup scene avails the probability of making positive exits.

“It’s been interesting to compare the results of the survey to my own exits. I can see that gaining more experience in angel investing, and having wider network covering the startup ecosystem really supports my possibilities towards positive exits. In my experience, many investors that have made exits will do new startup investments.” says Riku Asikainen, Vice Chairman of European Business Angels Network (EBAN).

FiBAN will continue making and developing IRR survey also in the future, aiming to make Finland one of the leading countries comparing startup data to business angel activities.

Show Comments